Savings Rate

Mar 21, 2021 20:10 · 246 words · 2 minute read

1.5 months ago I wrote about my salary and it’s growth over time. Growing your income is one side of gaining traction for your portfolio, increasing your savings rate is the other side to grow your assets over time.

I already gave a sneak-preview to my path to 100k and today I’d like to detail it a bit more. The following table shows my savings rate per year, my cumulated savings (so each year + previous years) and the corresponding portfolio value at the end of each year (on 31st of December).

| Year | Savings Rate | Cumulated Savings | Portfolio Value | Portfolio Growth |

|---|---|---|---|---|

| 2016 | - | 4.500 € | 4.529 € | - |

| 2017 | 50,03% | 21.650 € | 23.442 € | 518% |

| 2018 | 33,10% | 34.050 € | 31.290 € | 133% |

| 2019 | 33,69% | 50.350 € | 54.653 € | 175% |

| 2020 | 72,06% | 84.050 € | 96.458 € | 176% |

2017 was the year when I started to work full-time after finishing my Master in mid of 2016. And that’s basically also the point of inflection when I started to take savings seriously and set up a monthly savings plan. Initially the amount was rather low but I adapted it to my growing salary over the years and as you see I was able to achieve quite a savings rate in 2020.

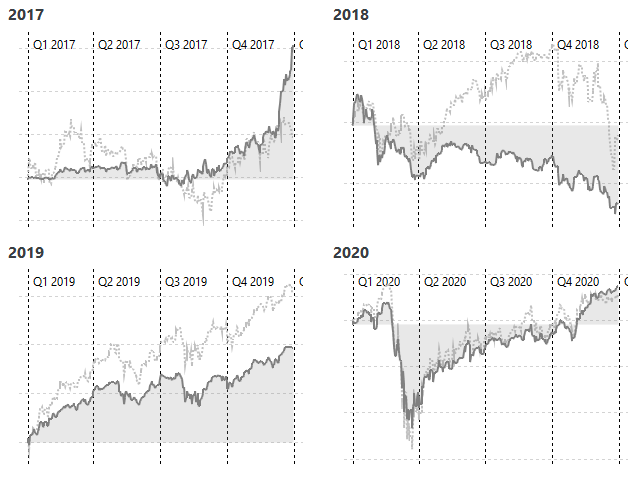

Performance-wise I had only one bad year in 2018 (where portfolio value was below my invested money) so far, which was mostly caused by my small position of crypto-currencies dropping from their all-time-highs at the beginning of 2018.